galaksi.site

Prices

How To Calculate State Tax

How much are your employees' wages after taxes? This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. In addition to the statewide sales and use tax rate, some cities and counties have voter- or local government-approved district taxes. District tax areas. Free calculator to find the sales tax amount/rate, before tax price, and after-tax price. Also, check the sales tax rates in different states of the U.S. The local income tax is calculated as a percentage of your taxable income. Local officials set the rates, which range between % and % for the current. To calculate your effective tax rate, find your total tax on your income tax return and divide it by your taxable income. Your effective tax rate is a good. Multiply line 9 by percent ). If the result is zero or less, enter “0.” Utah has a single tax rate for all income levels, as follows. Use this tool to: Estimate your federal income tax withholding; See how your refund, take-home pay or tax due are affected by withholding amount; Choose an. Double check your tax calculation! Enter the taxable income from your tax form and we will calculate your tax for you. Line references from each Missouri. Determine the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms or SR). How much are your employees' wages after taxes? This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50 states. In addition to the statewide sales and use tax rate, some cities and counties have voter- or local government-approved district taxes. District tax areas. Free calculator to find the sales tax amount/rate, before tax price, and after-tax price. Also, check the sales tax rates in different states of the U.S. The local income tax is calculated as a percentage of your taxable income. Local officials set the rates, which range between % and % for the current. To calculate your effective tax rate, find your total tax on your income tax return and divide it by your taxable income. Your effective tax rate is a good. Multiply line 9 by percent ). If the result is zero or less, enter “0.” Utah has a single tax rate for all income levels, as follows. Use this tool to: Estimate your federal income tax withholding; See how your refund, take-home pay or tax due are affected by withholding amount; Choose an. Double check your tax calculation! Enter the taxable income from your tax form and we will calculate your tax for you. Line references from each Missouri. Determine the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms or SR).

For tax year and beyond, the tax rate for Arizona taxable income is %. How to Calculate Withholding. The withholding formula helps you identify your tax. State income tax rates range from 4% to %, but you may be able to lower your tax bill with various deductions and credits. These include a standard. Multiply the applicable county and municipal/district combined tax rate to the county tax appraisal of the property. Real Property Taxes: The county. Calculation of Sales and Use Taxes.” Any person making taxable sales in Florida must separately state Florida sales tax on each customer's invoice, sales. Use these Free State Income Tax Calculators to Estimate Your State Taxes Owed and Know Your State Income Tax Rate Based on Your Information. sales price, cigarette tax and shipping charges. The sum of the cigarette tax and use tax represents the total tax due. Step Two - Calculate Penalty and. The tax values can be used for ES estimation, planning ahead, or comparison. Modify values and click calculate to use. File Status. Single. to the Constitution of Alabama of (proclaimed ratified December 13, ) provided deduction for federal income taxes paid by individual taxpayers. Knowing your income tax rate can help you calculate your tax liability for unexpected income, retirement planning or investment income. This calculator. Free Sales Tax Calculator. Automated Tax Rates Lookup. Use any USA address, city, state, or zip code to find real-time sales tax rates across the USA. Calculating Income Tax Withholding. North Dakota relies on the federal Form W-4 (Employee's Withholding Allowance Certificate) to calculate the amount to. Calculate your federal taxes with H&R Block's free income tax calculator tool. Answer a few, quick questions to estimate your tax refund. State of Delaware is required to pay annual franchise tax. The minimum tax is $, for corporations using the Authorized Shares method and a minimum tax. Use this calculator to estimate your marginal tax rate for the tax year. Plus, easily calculate your income tax rate and tax bracket based on your income. Enter your city and zip code below to find the combined sales tax rate for a location. If you'd like to calculate sales tax with product exemptions. See how to find the right tax preparer for you and check out our tips if you need help determining your residency status! · Save time and money by preparing. Historical Tax Tables may be found within the Individual Income Tax Booklets. Tax Calculators. Use these online calculators to calculate your quarterly estimated income taxes, the interest amount due on your unpaid income tax, or the. If you are paying sales or withholding tax late, remember NOT to include a timely compensation deduction. How do I calculate the Additions to Tax and Interest.

Sexual Fling

HAVE A FLING meaning: 1. to have a short sexual relationship with someone: 2. to have a short sexual relationship with. Learn more. Join Mei on a journey of discovery and desire in "Sex Ghoul Fling." Will you succumb to the forbidden temptations of the ghoul, or will you forge a path to. deliberately short-term sexual relationship between two people. Longer than a one-night stand, not as serious-sounding as affair. FLING meaning: 1: to throw or push (something) in a sudden and a brief sexual relationship. She had a fling with her boss. [+] more examples. Restoring sexual intimacy after infidelity should happen as soon as possible (without either partner feeling forced or violated). Restoring sexual intimacy after infidelity should happen as soon as possible (without either partner feeling forced or violated). fling · fornication · hanky-panky · immorality · infidelity · matinee · playing around · relationship · thing · two-timing · affair. nounas in illicit sexual. One of these fields include relationships and sex. A study published by the Archives of Sexual Behavior reported that sixty percent of college students have. No woman worth marrying would have a last sexual fling before marriage. This sort of skanky behavior is the province of women no man wants to make a wife. HAVE A FLING meaning: 1. to have a short sexual relationship with someone: 2. to have a short sexual relationship with. Learn more. Join Mei on a journey of discovery and desire in "Sex Ghoul Fling." Will you succumb to the forbidden temptations of the ghoul, or will you forge a path to. deliberately short-term sexual relationship between two people. Longer than a one-night stand, not as serious-sounding as affair. FLING meaning: 1: to throw or push (something) in a sudden and a brief sexual relationship. She had a fling with her boss. [+] more examples. Restoring sexual intimacy after infidelity should happen as soon as possible (without either partner feeling forced or violated). Restoring sexual intimacy after infidelity should happen as soon as possible (without either partner feeling forced or violated). fling · fornication · hanky-panky · immorality · infidelity · matinee · playing around · relationship · thing · two-timing · affair. nounas in illicit sexual. One of these fields include relationships and sex. A study published by the Archives of Sexual Behavior reported that sixty percent of college students have. No woman worth marrying would have a last sexual fling before marriage. This sort of skanky behavior is the province of women no man wants to make a wife.

Whether a one-night stand, casual fling, or long-term relationship, talking about sex is essential for obtaining sexual consent, and ensuring those involved. FLING meaning: 1: to throw or push (something) in a sudden and a brief sexual relationship. She had a fling with her boss. [+] more examples. An act of moving the limbs or body with violent movements, especially in a dance. A short romantic, oftentimes sexual, relationship. fling · fornication · hanky-panky · immorality · infidelity · matinee · playing around · relationship · thing · two-timing · affair. nounas in illicit sexual. A fling with somebody is more on the level of having fun with them, typically physically, that doesn't involve a serious commitment. Flings are often on the. Find helpful customer reviews and review ratings for Spring Fling G-spot Vibrator Pure Romance Sex Toy Orange Flower Head at galaksi.site CASUAL FLING meaning | Definition, pronunciation, translations and examples in If two people have a fling, they have a brief sexual relationship. Sexual relationships work best when everybody is clear about what they want. Many people confuse love, commitment, and sex, or assume the three always go hand-. Affairs. It is believed that Clinton began a personal relationship, an improper sexual relationship or any other kind of improper relationship". Another way to say Sexual Fling? Synonyms for Sexual Fling (other words and phrases for Sexual Fling). Find 34 different ways to say SEXUAL RELATIONSHIP OUTSIDE OF MARRIAGE, along with antonyms, related words, and example sentences at galaksi.site The affair can be solely sexual or solely physical or solely emotional – or a combination of these. People who involve themselves in affairs do so out of the. An act of moving the limbs or body with violent movements, especially in a dance. A short romantic, oftentimes sexual, relationship. How Can I Recover Sexual Desire for My Husband after My Affair? Introduction: Last week I promised I would get off the subject of infidelity, and on to. To have a brief, noncommittal sexual relationship (with someone). I had a few flings in college, but it was only after I graduated that I started having any. relationship. Sexual fulfillment: Some men may pursue affairs to fulfill sexual desires or explore sexual fantasies that they feel are unmet within their. have a fling. verb as in dally/dally with. Compare fling. Browse related words to learn more about word associations. dallied. verbas in have love affair. Relationship Characteristics. Among teens who have had sex, the majority of teens viewed their first sexual relationship as more than a casual fling. Eighty. In fact, many affairs happen in relationships that are otherwise very happy. There does not need to be some kind of emotional lack or sexual dysfunction for.

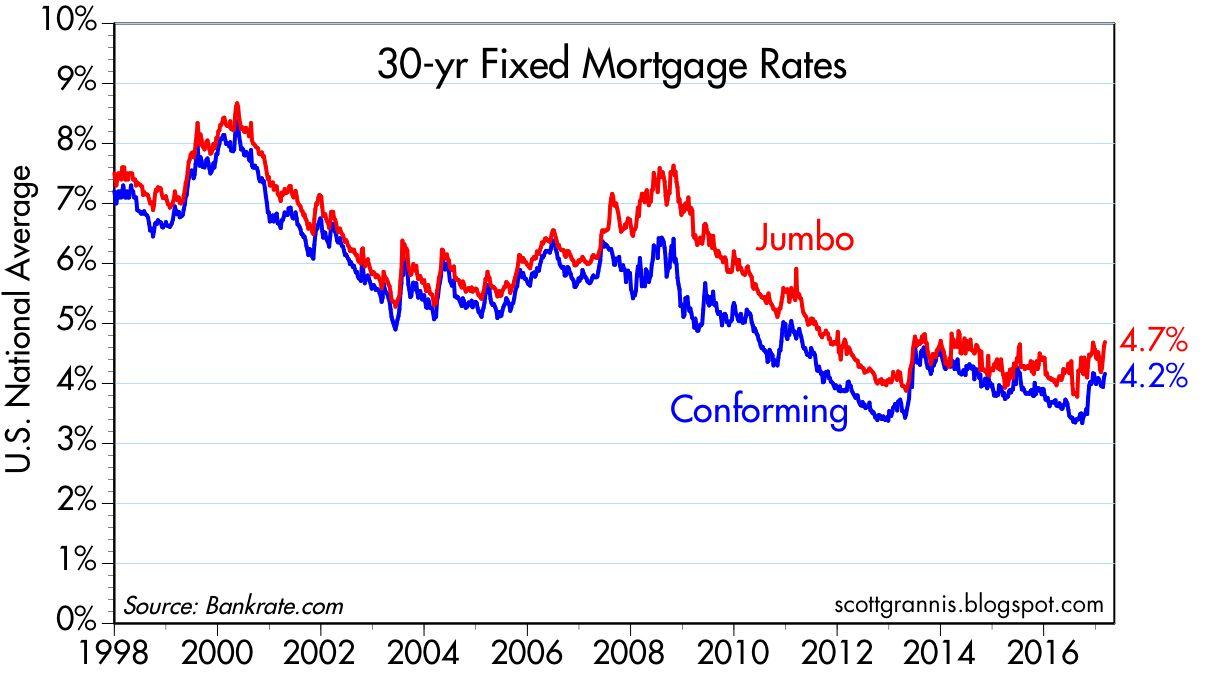

30 Yr Fixed Mortgage Rate Chart

Interactive historical chart showing the 30 year fixed rate mortgage average in the United States since The chart below shows interest rates for year fixed-rate, year fixed-rate, and 5/1 ARM mortgages as reported by Freddie Mac to the Federal Reserve Bank. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Year Fixed Mortgage Rates* ; , % ; , % ; , % ; , %. FHA Year Fixed-Rate Mortgage: An FHA loan is a mortgage insured by the Federal Housing Administration. The FHA is a federal government agency that is part of. Year Fixed Mortgage Rate galaksi.site US30YFRM:Exchange · Open · Day High · Day Low · Prev Close Basic Info. 30 Year Mortgage Rate is at %, compared to % last week and % last year. This is lower than the long term average of %. Current Mortgage Interest Rates · Mortgage rates today: Thursday, September 5, · Daily mortgage rates chart · Why mortgage rates change every day. The average rate on a year fixed mortgage held steady at % as of September 5th, remaining at its lowest level since mid-May , according to. Interactive historical chart showing the 30 year fixed rate mortgage average in the United States since The chart below shows interest rates for year fixed-rate, year fixed-rate, and 5/1 ARM mortgages as reported by Freddie Mac to the Federal Reserve Bank. Find average mortgage rates for the 30 year fixed rate mortgage from a variety of sources including Mortgage News Daily, Freddie Mac, etc. Year Fixed Mortgage Rates* ; , % ; , % ; , % ; , %. FHA Year Fixed-Rate Mortgage: An FHA loan is a mortgage insured by the Federal Housing Administration. The FHA is a federal government agency that is part of. Year Fixed Mortgage Rate galaksi.site US30YFRM:Exchange · Open · Day High · Day Low · Prev Close Basic Info. 30 Year Mortgage Rate is at %, compared to % last week and % last year. This is lower than the long term average of %. Current Mortgage Interest Rates · Mortgage rates today: Thursday, September 5, · Daily mortgage rates chart · Why mortgage rates change every day. The average rate on a year fixed mortgage held steady at % as of September 5th, remaining at its lowest level since mid-May , according to.

A year fixed-rate mortgage is the most common mortgage loan option. It has a repayment period of 30 years and the interest rate doesn't change throughout the. Today. The average APR on the year fixed-rate jumbo mortgage is %. Last week. %. Mortgage Rate Trends. United States MBA Year Mortgage Rate ; Actual: % ; Forecast: ; Previous: %. Fannie Mae expects the average year fixed mortgage rate to trend slightly down between for Q3 and Q4 Fannie Mae forecasts the downward trend will. For today, Thursday, September 05, , the current average year fixed mortgage interest rate is %, remaining stable over the last seven days. If you're. A year fixed-rate mortgage is a home loan with a repayment term of 30 years and an interest rate that remains the same throughout the life of the loan. Current mortgage and refinance rates ; % · % · % · % ; % · % · % · %. 30 Yr. Jumbo, %, --, %. View current 30 year fixed mortgage rates from multiple lenders at galaksi.site®. Compare the latest rates, loans, payments and fees for 30 year fixed. The average interest rate is % for a year, fixed-rate mortgage in the United States, per mortgage technology and data company Optimal Blue. National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 1 basis point from % to % on Wednesday. Current and historical mortgage rate charts showing average year mortgage rates over time. See today's rates in context. Weekly Data ; August 22, , 30‑Yr FRM %, Rate Change %, 15‑Yr FRM %, Rate Change % ; August 15, , 30‑Yr FRM %, Rate Change +%, Today. The average APR on the year fixed-rate jumbo mortgage is %. Last week. %. Mortgage Rate Trends. Fixed year mortgage rates in the United States averaged percent in the week ending August 30 of Mortgage Rate in the United States averaged Conforming and Government LoansExpand Opens DialogExpand · Year Fixed Rate · Interest% · APR%. A year fixed rate mortgage is a home loan structure that establishes an unchanging interest rate throughout the course of the loan. The interest rate charged. Line graph showing last 90 days of the year fixed-rate new purchase. Mortgage Rates. Graph and download economic data for Year Fixed Rate Veterans Affairs Mortgage Index (OBMMIVA30YF) from to about veterans, year. National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 8 basis points from % to % on Thursday.

Do Non Profit Organizations Make Money

Non-profit organization to not "make money" but they do collect it, and from the money they collect, they have costs, expense and usually some. Donations and grants are an obvious source of funding for most nonprofits, but there are other, often overlooked ways to earn money. And if you're looking for a. Ways for Nonprofit Organizations To Make Money · Auctions · Corporate sponsorships · Individual donations · Endowments · Galas · Grants · Memberships · Selling. Nonprofits can and do use the following sources of income to help them fulfill their missions: Fees for goods and/or services Individual donations and major. Non-profit founders earn money for running the organizations they founded. They often put in long work hours and make far less money than executives at for-. But this isn't the case--nonprofits should make money and employees can be paid a salary. This includes the founder if the founder is performing mission-related. Nonprofit employees are paid the same way that any employee is paid. They receive compensation that is determined by their position and location, and can. Often, the organization can pay lower wages to employees (such as minimum wage) with the promise of giving back to the community. While most organizations don't. Basically, paying you as the founder must be in the best interest of the mission. The first chunk of money coming into the nonprofit probably isn't going toward. Non-profit organization to not "make money" but they do collect it, and from the money they collect, they have costs, expense and usually some. Donations and grants are an obvious source of funding for most nonprofits, but there are other, often overlooked ways to earn money. And if you're looking for a. Ways for Nonprofit Organizations To Make Money · Auctions · Corporate sponsorships · Individual donations · Endowments · Galas · Grants · Memberships · Selling. Nonprofits can and do use the following sources of income to help them fulfill their missions: Fees for goods and/or services Individual donations and major. Non-profit founders earn money for running the organizations they founded. They often put in long work hours and make far less money than executives at for-. But this isn't the case--nonprofits should make money and employees can be paid a salary. This includes the founder if the founder is performing mission-related. Nonprofit employees are paid the same way that any employee is paid. They receive compensation that is determined by their position and location, and can. Often, the organization can pay lower wages to employees (such as minimum wage) with the promise of giving back to the community. While most organizations don't. Basically, paying you as the founder must be in the best interest of the mission. The first chunk of money coming into the nonprofit probably isn't going toward.

Nonprofits can make money from financial sponsorships. However, they can also get other forms of sponsorship such as unique coupons, products, services, etc. But this isn't the case--nonprofits should make money and employees can be paid a salary. This includes the founder if the founder is performing mission-related. First, it cannot be a charity or an organization that could be registered as a charity. Second, it must be organized and operated exclusively for a purpose. Non-profits get money from different places. People, companies, and even governments donate money to them. They might also get money from events. Non-profit founders earn money for running the organizations they founded. They often put in long work hours and make far less money than executives at for-. Nonprofits are allowed to make a profit, but they must be funneled back into the organization's activities. There are thousands of nonprofits throughout the United States that employ individuals to work on a full-time basis. It is perfectly legal to pay individuals. The founders of a nonprofit are not permitted to make a profit or benefit from the net earnings of the organization. They can make money in. The founders of a nonprofit are not permitted to make a profit or benefit from the net earnings of the organization. They can make money in various other ways. Instead, their goal is to make a profit the same way for-profit businesses do, but all money funnels back into the organization to help keep it running. They. With non-profit organizations, however, profit isn't the end goal. Humanitarian organizations, NGOs, hospitals, political organizations, labor unions. The obvious tax benefits of becoming a nonprofit weigh against the flexibility granted to for-profit organizations that have the leverage to raise money and. Nonprofits can also garner donations from corporations, charitable foundations, and other for-profit institutions. In addition to financial donations. How Do Nonprofits make Money? · Products and services – on average about 60% of revenue source · Grants, Government support · Charitable Giving Donation of. While a non-profit organisation is not able to earn a taxable profit, those who founded the organisation, manage the running of it or work for it. Not-for-profit organizations do not earn profits for their owners. All of the money earned by or donated to a not-for-profit organization is used in. Despite the hype, earned income accounts for only a small share of funding in most nonprofit domains, and few of the ventures actually make money. Rhetoric and. Often, the organization can pay lower wages to employees (such as minimum wage) with the promise of giving back to the community. While most organizations don't. Donations and grants are an obvious source of funding for most nonprofits, but there are other, often overlooked ways to earn money. And if you're looking for a. The nonprofit's revenue can support a stable salary. Many nonprofit leaders start their organizations using their own seed money, and not everyone has the.

Interest Rate On Equity Line Of Credit

All rates quoted are subject to change monthly, the maximum interest rate is 18% and the minimum interest rate is %. The rate may increase after the. For Home Equity Lines of Credit: Variable Annual Percentage Rate (APR) can be as low as Prime plus % (currently % variable APR) and as high as Prime plus. As of August 28, , the current average home equity loan interest rate is percent. The current average HELOC interest rate is percent. LOAN TYPE. For Home Equity Lines of Credit: Variable Annual Percentage Rate (APR) can be as low as Prime plus % (currently % variable APR) and as high as Prime plus. HELOC rates and payment examples ; $10,, $, $, $, $10, ; $25,, $, $, $, $25, Any variable advances taken during the Promotional Period shall accrue interest at the Special Advance Rate up until the expiration of the Promotional Period. Take advantage of these interest rate discounts · % · Up to % · Up to % · Get more with a Bank of America Home Equity Line of Credit · What can a HELOC. PNC, NerdWallet's #1 HELOC lender for , is ideal for paying off credit cards, home renovations, mortgage refinance & allows you to lock a fixed rate. Average overall rate: %; year fixed home equity loan: %; year fixed home equity loan: %. All rates quoted are subject to change monthly, the maximum interest rate is 18% and the minimum interest rate is %. The rate may increase after the. For Home Equity Lines of Credit: Variable Annual Percentage Rate (APR) can be as low as Prime plus % (currently % variable APR) and as high as Prime plus. As of August 28, , the current average home equity loan interest rate is percent. The current average HELOC interest rate is percent. LOAN TYPE. For Home Equity Lines of Credit: Variable Annual Percentage Rate (APR) can be as low as Prime plus % (currently % variable APR) and as high as Prime plus. HELOC rates and payment examples ; $10,, $, $, $, $10, ; $25,, $, $, $, $25, Any variable advances taken during the Promotional Period shall accrue interest at the Special Advance Rate up until the expiration of the Promotional Period. Take advantage of these interest rate discounts · % · Up to % · Up to % · Get more with a Bank of America Home Equity Line of Credit · What can a HELOC. PNC, NerdWallet's #1 HELOC lender for , is ideal for paying off credit cards, home renovations, mortgage refinance & allows you to lock a fixed rate. Average overall rate: %; year fixed home equity loan: %; year fixed home equity loan: %.

%2 APR thereafter on loan amounts up to $, View our other HELOC rates including our Jumbo HELOC and 5 Year Fixed Rate HELOC options. We also have. Protects against rising interest rates · Have up to 5 Fixed-Rate Advances at one time · Fixed rates available for 5, 10, 15 or year terms · Fixed-rate. Rates start at % APR, may be as much as % APR and are subject to change at any time. Advertised APR assumes a % autopay discount. Actual APR based on borrower's credit history and loan terms. Variable interest rates calculated by index (prime rate as published in Wall Street Journal) +. As of November 6, , the variable rate for Home Equity Lines of Credit ranged from % APR to % APR. Rates may vary due to a change in the Prime Rate. New HELOCs Introductory Rate · Intro rate of % APR for 6 billing cycles from the open date. · After 6 billing periods, an ongoing variable rate will apply. Limited-time % APR intro fixed rate for first 6 months Borrow only what you need, now with a lower rate. (After the introductory period, a low standard. A home equity line of credit, or HELOC, is a revolving credit line that's secured by the equity you've built in your home. The HELOC can be used as needed. Fixed Rate Lock option available. Monthly Payments. Payment amount varies, depending on balance and current interest rate. Flexibility of. Interest rates and fees. Annual Percentage Rate (APR). For a limited time, % introductory annual percentage rate (APR) for the first six billing cycles from. A competitive HELOC rate for most homeowners currently ranges from 8% to 10%. Several factors impact the interest rate such as prime rate, loan repayment term. Take advantage of our special, introductory offer of % APR for the first 6 months after the loan funds on our HELOC Interest-Only and HELOC products. Home Equity Loans are fixed-rate loans. Rates are as low as % APR and are based on an evaluation of credit history, CLTV (combined loan-to-value) ratio. With a HELOC, you can: · Variable Rates as Low as · % APR*. Tap into your home equity with low fixed rate loan options · Current Home Equity Loan Rates · Term Length Options: · Rate Range: · Year Fixed Rate · % - Line of Credit Interest Rates ; $, and above · 1 of 5 ; $75, - $, · 2 of 5 ; $50, - $74, · 3 of 5 ; $25, - $49, · 4 of 5 ; Up to $24, · 5 of. *All home equity rates are based on your credit history, current credit report and loan to value ratio. The HELOC is a variable rate loan. All loans are subject. 1 For loans in MO and KS the % Introductory Annual Percentage Rate (APR) is available on Home Equity Lines of Credit with a loan-to-value of 85% or less if. Rates vary from % APR to % APR depending on property state, loan amount and other variables. Please consult a banker for pricing in your region. Your. Apply with our % online application in minutes and with funding in as few as 5 days. While traditional HELOCs usually have variable interest rates that can.

What Does Limit Buy Mean

:max_bytes(150000):strip_icc()/using-limit-orders-when-buying-or-selling-stocks-3140523_FINAL-552f8688df274383aa4a9320f7c490af.gif)

This means you're guaranteed to get your limit price or a better price if your order is executed. Buy stop order: With a buy stop order, you set a target. A limit order is an instruction you give to buy or sell an asset at a specific price. . The instruction is usually given to a broker that will automatically. A limit order is used to buy or sell a security at a pre-determined price and will not execute unless the security's price meets those qualifications. A limit order is an instruction to your trading provider or broker that tells them to execute a trade at a more favorable price than the current market price. By definition, a limit order is a type of order to purchase or sell a security at a specified price or better. This means that the order's. A limit order allows investors to purchase or sell a stock at a specified price or better. In case of buy limit orders, the order will only get executed below. Limit orders allow you to specify the maximum price you'll pay when buying securities, or the minimum you'll accept when selling them. A limit order in financial markets is an instruction to buy or sell a stock or other security at a specified price. A limit order is an order to either buy stock at a designated maximum price per share or sell stock at a minimum price share. This means you're guaranteed to get your limit price or a better price if your order is executed. Buy stop order: With a buy stop order, you set a target. A limit order is an instruction you give to buy or sell an asset at a specific price. . The instruction is usually given to a broker that will automatically. A limit order is used to buy or sell a security at a pre-determined price and will not execute unless the security's price meets those qualifications. A limit order is an instruction to your trading provider or broker that tells them to execute a trade at a more favorable price than the current market price. By definition, a limit order is a type of order to purchase or sell a security at a specified price or better. This means that the order's. A limit order allows investors to purchase or sell a stock at a specified price or better. In case of buy limit orders, the order will only get executed below. Limit orders allow you to specify the maximum price you'll pay when buying securities, or the minimum you'll accept when selling them. A limit order in financial markets is an instruction to buy or sell a stock or other security at a specified price. A limit order is an order to either buy stock at a designated maximum price per share or sell stock at a minimum price share.

A limit order is an instruction to your broker to execute a trade at a particular level that is more favourable than the current market price. A Limit order is an order to buy or sell at a specified price or better. The Limit order ensures that if the order fills, it will not fill at a price less. In a limit order, the investor has to specify a quantity and the desired price at which he or she wants to make the transaction. For example, for an investor looking to buy a stock, a limit order at $50 means Buy this stock as soon as the price reaches $50 or lower. The investor would. Limit buys let you set the highest price you're willing to pay for a security. Your order will only execute if the ask price reaches or goes below that price. Limit orders are a type of execution tool that trigger a buy or sell trade at a specified price that is above or below the current market price. A market order is designed to execute at a stock's current price—the market price—when the order reaches the exchange. You'll buy at the ask price or sell. When the price of the stock achieves the set stop price, a limit order is triggered, instructing the market maker to buy or sell the stock at the limit price. The order will only be filled if the market price aligns with or exceeds the limit price. How does a stop-limit order work? Those are certainly a lot of words. The Buy Limit is the price level set by the trader when they wish to buy their asset in the future. The key difference between a Buy Stop and a Buy Limit, is. A buy limit order is an order that instructs your broker to buy a stock or other security only at a specific maximum price. Limit orders are types of stock trades that let you buy or sell at a set price. Limit buy orders set the most youre willing to pay for a stock. A day limit order, as the name implies, expires at the end of the trading day. An investor usually set a day limit order at or around the bid price -- the. A limit order is an order made with a brokerage firm or bank for the sale or purchase of a certain financial instrument at a designated price or better. When you place a limit order to buy, the stock is eligible to be purchased at or below your limit price, but never above it. You may place limit orders either. How do limit orders work? Say you want to buy a particular stock at $11 per share or less, and it's currently trading at $ A limit order will execute a. A limit order is an order that instructs the broker to buy or sell a specific security at a specific price. That means the order will only be executed if the. In the case where you look to place a sell limit order, this is normal. As a reminder, a sell limit order is used to indicate a minimum. A limit order allows investors to buy or sell securities at a price they specify or better, providing some price protection on trades. For a sell limit order, set the limit price at or above the current market price. Examples. Buy limit order. You want to purchase XYZ stock, which is trading at.